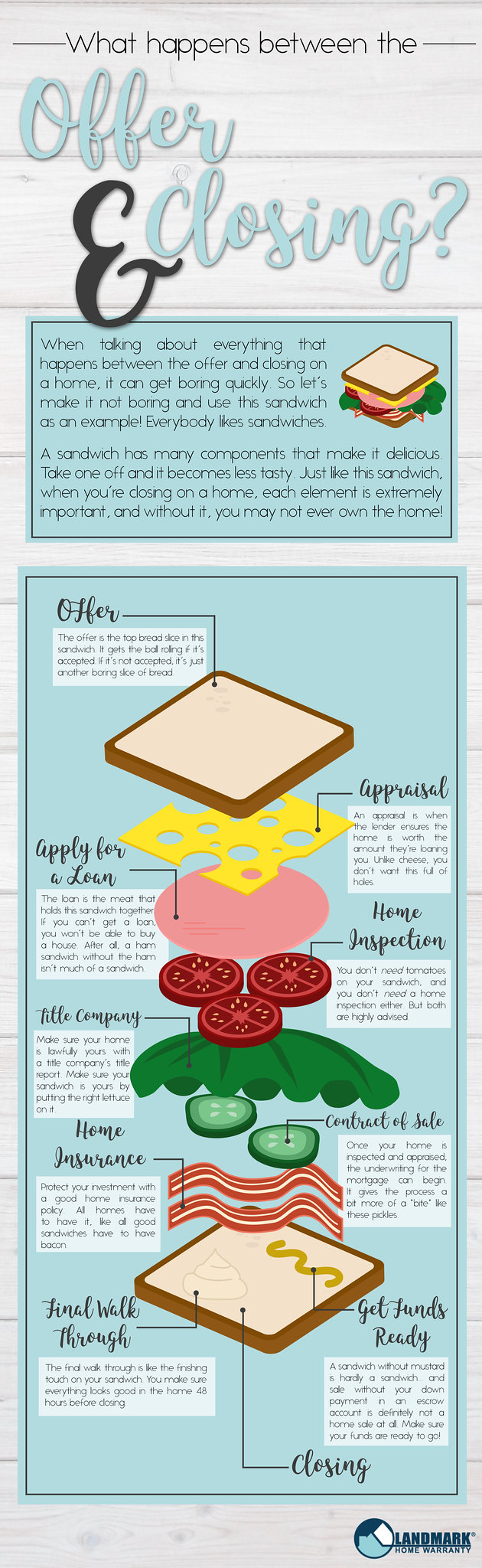

After weeks, even months of searching, you found the perfect home and you made an offer on it. You may have had to go back and forth with the seller to get to a point where the offer is something you both agree to as far as price, closing costs, closing dates and contingencies. Once you both agree and the offer is accepted, you're on your way to becoming the owner of the home! Before you get your moving van packed up and you start buying curtains, remember, you're not out of the clear yet. You don't technically own the home, and there's a lot to get done before you sign the final papers and are handed the keys and title. Ready to get going? Read on to find out what to do next.

- Apply For a Loan

At this point, you've more than likely been pre-approved for a loan. A pre-approval from a loan company shows the seller and seller's agent that you have the ability to find a loan and finance the purchase of a home through a mortgage for the price you're offering. It's generally included in an offer on a home. Once you have a pre-approval and your offer is accepted, you need to apply for a loan that makes the most sense for you. This may mean shopping around for the best rates from local lenders, or hiring a mortgage broker to find you the best loan possible.

- Property Appraisal

Part of the closing process is to appraise the property. While creating a mortgage for a home, the lender wants to know how much the property is worth. They want to make sure the amount of money the bank is lending to the buyer isn't more than what the home is worth because there's a higher chance the buyer wouldn't be able to pay back the mortgage if they sold it down the line. Thus, the lender will have an appraiser come out to the property and determine its worth. The appraiser will also look at comparable homes that have been sold in the same area to ensure that the price offered is correct.

If the home appraises for more than the price the buyer will be paying, this is great for the bank and for the buyer. In this case, the sale of the home will go through. However, if the home appraises for less than the price the buyer will be paying, there may be some problems. The bank will offer to loan the money for the amount the home appraises for, and the buyer will either have to pay more for a down payment or the seller and buyer will have to reach an agreement of a smaller purchase price.

- Home Inspection

During this in-between time, you will want to hire a home inspector to go through the property and take a look at the appliances, systems and structure of the home. Some lenders will require a home inspection, but even if yours doesn't, you should hire a home inspector regardless. The inspector will go through the house and tell you what state the home is in and what you'll need to have repaired. These items are things that you can give to the seller and ask to have repaired or replaced. Not only will this help you determine what needs to be fixed before (and during) your time in the home, the inspector will educate you on how to turn on systems and appliances and let you ask questions about the home as it's inspected.

Click here for more details on what to do before, during and after home inspection.

- Title Search and Home Warranty

The title company will also do a title search on the property to make sure there are no liens against the home and that it can fully be yours when the time comes. They will possibly do a property survey to ensure the piece of land you're buying is the accurate acreage, and that none of your neighbors have encroached upon your property lines. You'll be given the title company's report, and if there's nothing holding the title, you can go forward with the sale.

If your contract of sale includes a home warranty, your title company will purchase a home warranty for you, which will be billed to the seller, the agent or you during closing costs. If you have a particular home warranty company that you want to go with on your home, you can tell the title company which home warranty company you want. You can also talk to your Realtor and see which home warranty company would be best for you before it is purchased.

If you're interested in looking at home warranties and their plans and pricing, use our plans and pricing tool here. You can get a customized pricing list for the specific home you're looking at purchasing.

- Contract of Sale (or Purchase of Sale) Is Made Official

Once the home is inspected, appraised and the seller has agreed to fix the problems that have come up in inspection, the Contract of Sale is made official and underwriters for the mortgage can begin to create the terms of mortgage, or go through the process of "underwriting." The loan underwriters will dig deep in your financial history to make sure you're good for paying back your mortgage payments, and you have enough funds to make a down payment and subsequent mortgage payments every month. Most of the time, closing is 30-60 days after the offer is accepted to ensure the underwriters of the mortgage have everything ready to go for closing.

- Home Insurance

Next, you'll need to get home insurance on your new home. This will be factored into your mortgage payment. (It's part of your taxes and fees). This money will be taken out each month and will go into an escrow account, where the taxes and fees will be paid annually.

- Get Funds Ready

Next, you'll need to make sure your funds are ready for the down payment on your home. If you're pulling the funds for a down payment out of an investment account, you'll need to do that straight away. Wherever you're planning on getting the money for the down payment, you'll need to make sure they're in your bank account or wired to an escrow account so that they're available to pay the down payment on closing day.

- Walk Through

Within 48 hours before closing, you'll go on your final walk through of the home. You'll look at the repairs the seller made based on the home inspection report, and make sure that everything in the home looks good. If you have questions about the appliances, or something you were expecting to have with the home when you purchased it that isn't there anymore, make sure to speak up during this walk through.

- Closing

Today is the day! Everything is made official. You'll sign all the paperwork at a title office and get the keys to your new home. You'll sign things like your loan amortization schedule, the details about your loan, and the sales contract. After signing for a while, you'll be able to take the keys back to your home. Congratulations! You're a homeowner.