When you start to look at investments, you can easily become swamped with all of the available information. There are thousands of ways to invest. Should you buy stock? Or perhaps you should start an art collection — that's an investment, too! What about investing in real estate? Many investors make their living off of buying and selling property.

What is a real estate investment?

Instead of purchasing property as a place to live, a real estate investment is when someone purchases property in order to make money.

A simple way to start investing in real estate is purchasing a home and renting it out. (Of course, you have to take responsibility for homeowners insurance and home warranty coverage) There are other (more complex) ways to get into real estate investing. Here are a few examples:

Renting Properties

Here is the simplest way to get into real estate investing! The owner of property rents it out to tenants and charges enough rent to cover the mortgage on the home, property taxes and maintenance (including home warranty coverage). If they want to make a profit, they'll increase the rent a bit, however, most real estate investors wait until the mortgage has been paid off to do this.

Although this investment seems straightforward, it can be a hard investment to make, as all of the responsibility of the home's maintenance goes to the landlord. Not only do they have to pay for any appliances or systems that fail, but they have to insure the home and keep it occupied. Many of these landlords opt to have a property management company to take care of picking up rent, inspecting the property for damage and maintaining it. Many property management companies purchase home warranty coverage for these properties as well. Home warranty coverage can repair or replace most of the major appliances and systems within a home when they fail from normal wear and tear. This home warranty coverage is an option for many properties, as long as they're not commercial.

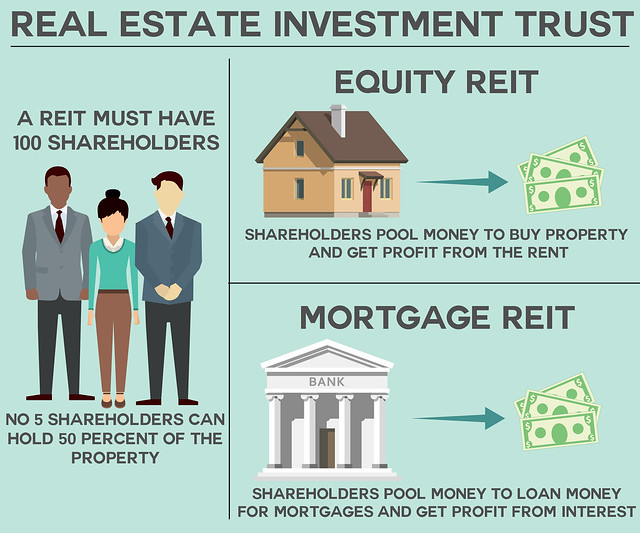

REIT — A Real Estate Investment Trust

A real estate investment trust works like a mutual fund for real estate. Each Real Estate Investment Trust lets small and large backers pool their money and acquire real estate in apartment buildings shopping malls, hotels, offices and more. Trusts have to have at least 100 shareholders, so long as 50% of the property isn't held between 5 of those investors. REITs have a return of at least 90%. This is a great way for real estate novices to get a larger payout without as much responsibility.

There are three different types of Real Estate Investment Trusts.

- Equity REIT

An Equity REIT is when shareholders pool their money to purchase property and then rent that property out to residents, or commercial entities. With residential equity REIT, and depending on the type of property owned, some shareholders choose to purchase home warranty coverage to take care of their investment's systems and appliances.

- Mortgage REIT

A mortgage REIT is when investors pool their money to invest in property mortgages. They loan money to the owners as a mortgage, and then are paid through the interest on the mortgage payments.

- Combined REIT

A combined REIT invests in properties and in the mortgages of properties.

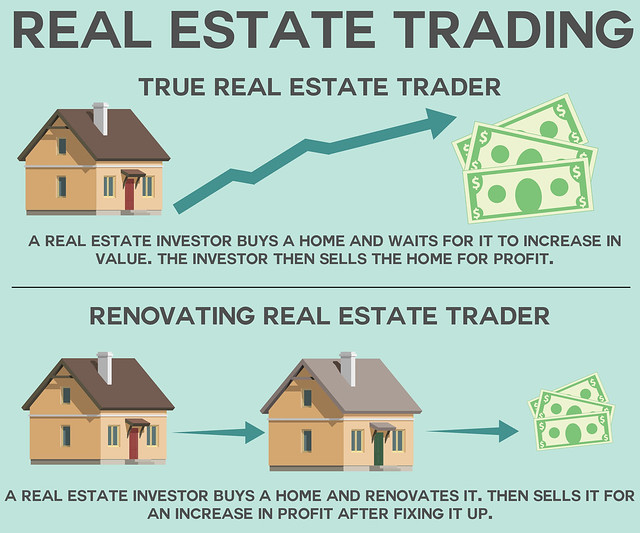

Real Estate Trading or "Flipping" Houses

You may have heard about individuals who flip houses. This is indeed a form of real estate investment, and is actually called real estate trading. This type of investor buys homes, but instead of getting profit from renting out the home, they wait until the property has risen in value to sell it again, getting profit from the increase in value.

There are two types of real estate trading.

- True Real Estate Trader

This real estate trader will put absolutely no money into the repair or improvement of a home. They won't make any renovations, or buy home warranty coverage to protect the house's systems and appliances. They will wait until the property value has increased and then sell the house, pocketing the different between what they paid and what they sold the house.

- Renovating Real Estate Trader

This type of investor does put money into a home. Instead of waiting for the property's value to increase naturally, this financier will find a home that is in need of some TLC. They will renovate and upgrade the home and hope to see a large payout when they sell the home for a higher price than it was purchased. Sometimes these real estate investors will live in the home for a long period of time in order to renovate it. Some of these types of investors will purchase home warranty coverage for their investment, or even sell the home with home warranty coverage included.

Real Estate Investment Groups

Another mutual fund type of real estate investment is a real estate investment group. This group is not as structured as a REIT, but has some of the same qualities. The group pools their money to purchase a rental property, and then gain profit by charging rent. This is a more alluring investment to those people who don't want to become landlords and worry about the responsibility of managing the property. Instead, the group hires a property management company to interview tenants, collect rent, handle service repair professionals, or work with the property's home warranty coverage company. As long as the home is in a residential area, many real estate investment groups see a benefit in paying for home warranty coverage to cover the costs of maintenance.

For more information about how you can get home warranty coverage on you real estate investment, go to our home warranty coverage page. Or, learn more about Landmark with our main page at www.landmarkhw.com.