Unless you're Dave Ramsey, you don't generally buy a home and pay for it in cash. Unless you have hundreds of thousands of dollars in your bank account, you're probably going to need to borrow some money. That's where a mortgage comes in!

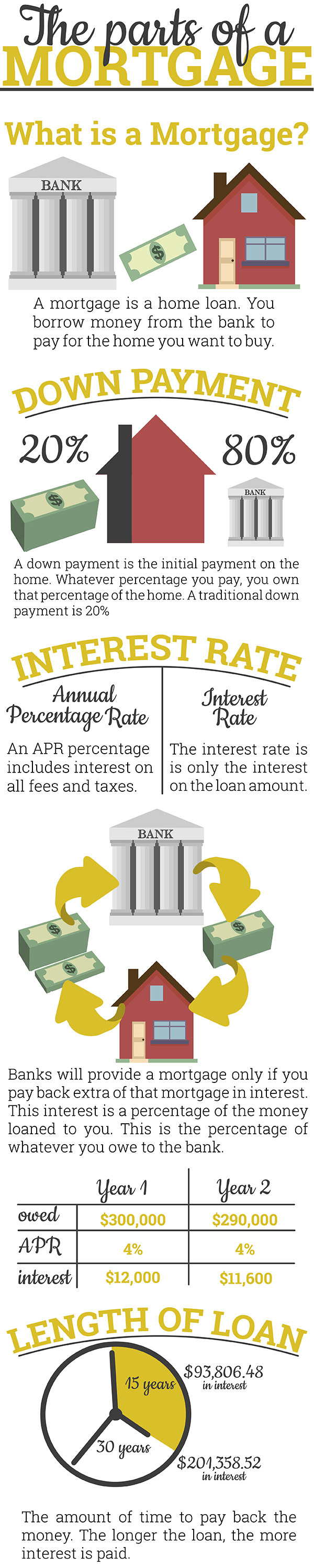

What is a mortgage?

A mortgage is a home loan. It differs from other loans, like student loans, because the lender technically owns the home. With a student loan, the lender can't take possession of your college degree if you don't pay them back, but a bank can repossess your home. If you don't pay your mortgage payments, the bank can take the home from you and evict you.

A mortgage isn't as simple as borrowing the money and then paying it back over time. There are many different elements that make up a mortgage, including a down payment, interest rate and length of the loan. All of these elements are present in most mortgages, although the stipulations do vary for different types of loans.

Down Payment

First of all, most banks require some sort of a down payment. Traditionally the amount has been 20% of the home's value, but in recent years some banks have accepted 3.5% for a down payment with certain mortgage plans. The amount of money you put down for a down payment means that you own that percentage of the home. If you put down a 20% down payment, you own 20% of the house. The mortgage for the other 80% of the home is owned by the bank.

Every time you pay a mortgage payment you are buying more of your home from the bank (this is also known as equity.) (Sometimes a home warranty plan is included in this down payment, but more often it is gifted to the buyer by the seller.)

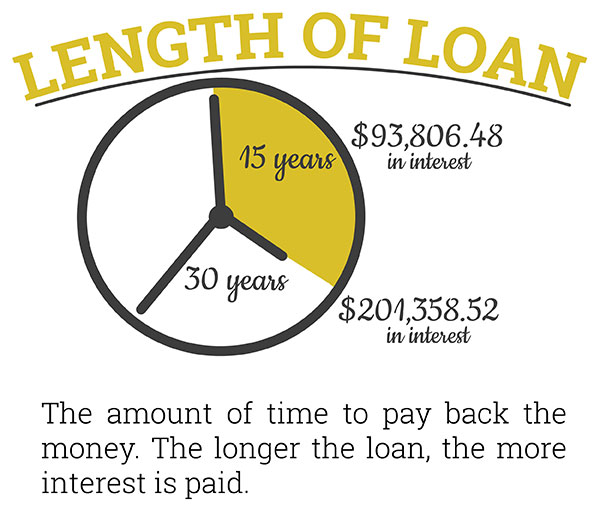

Length of Loan

Another element that all mortgages have is the length of the loan. This is simply how long a borrower has to pay the lender back , including the interest accrued on that amount. The shorter the length of the loan, the less you'll spend on interest over time.

Interest Rate

What is interest? A lender will only loan you money if you agree to pay it back, plus some extra. This extra is usually a percentage of the original amount you borrowed. (This original money you borrowed is called principal.) This extra money is referred to as "interest." This is how lenders make a profit. You'll be hard pressed to find a loan that doesn't include some sort of interest rate, and if you find one, be wary "“ most of these loans have hidden fees or a certain time period when you'll end up paying interest anyway.

You should shop around for the best interest rate and always make sure your interest rate is the Annual Percentage Rate.

What is the difference between APR and an Interest Rate?

APR stands for Annual Percentage Rate. The APR includes closing costs, taxes, the home insurance and home warranty plan and fees. An interest rate is just the percentage the bank expects back on the principal, nothing more. If you sign a mortgage with just an "interest rate" instead of an APR, you'll find out you're actually paying much more each month than what you were expecting. Most loans in this day and age include the APR when signing, but be watchful.

How is your Annual Percentage Rate Calculated?

Sometimes new homebuyers see the APR on their loan and do a quick calculation, assuming that percentage rate is for the life of the loan. Unfortunately, the percentage rate is an annual fee, meaning you pay that percentage each year.

For example, say you have a $300,000 loan with a 4% APR for 30 years.

The first year you'll pay $12,000 in interest. (4% of $300,000). The next year, you'll have paid $10,000 on your mortgage, so you'll owe the bank $290,000. Assuming your interest rate stays the same each year, you will pay 4% of what you owe the bank, so you'll pay $116,000 (4% of 290,000).

Those are all of the parts of the mortgage! The down payment, interest, and the length of the loan all make up a mortgage.

For more information on home warranty plans, you can check out Landmark's plans and pricing page. If you're interested in purchasing a home warranty plan for a newly purchased home, make sure to contact your realtor to ask about your options. If you want a home warranty plan on a home you have owned for a few years, you can learn more about our home warranty coverage options.