If you've browsed through property listings online, it's likely you've run across a "Short Sale" label on some. This label might not mean much to you as you look at other aspects of the home, like the space, how many rooms or its location, but if the home becomes one that you're interested in, it can affect your purchase greatly. Short sales can be a mixed bag for buyers; and while there are definite benefits to purchasing a short sale property, there are some detriments you must know about before buying.

What Is a Short Sale?

A short sale is when the money obtained from the sale of a home isn't enough to cover the debt owed on the home. So, if a homeowner can only sell their house for $250,000, but has a mortgage on it that's $300,000, they would have to sell the home in a short sale. Of course, the homeowner would have to be defaulting on their loans (not being able to make payments on the house) and have the mortgage company approve this in order for it to be an actual short sale.

If you missed the first blog in this series, make sure to go back and read it here: What is a Short Sale?

So, what exactly does that mean as a buyer? There are a lot of things — both good and bad — you need to know if you're considering purchasing a short sale for a home.

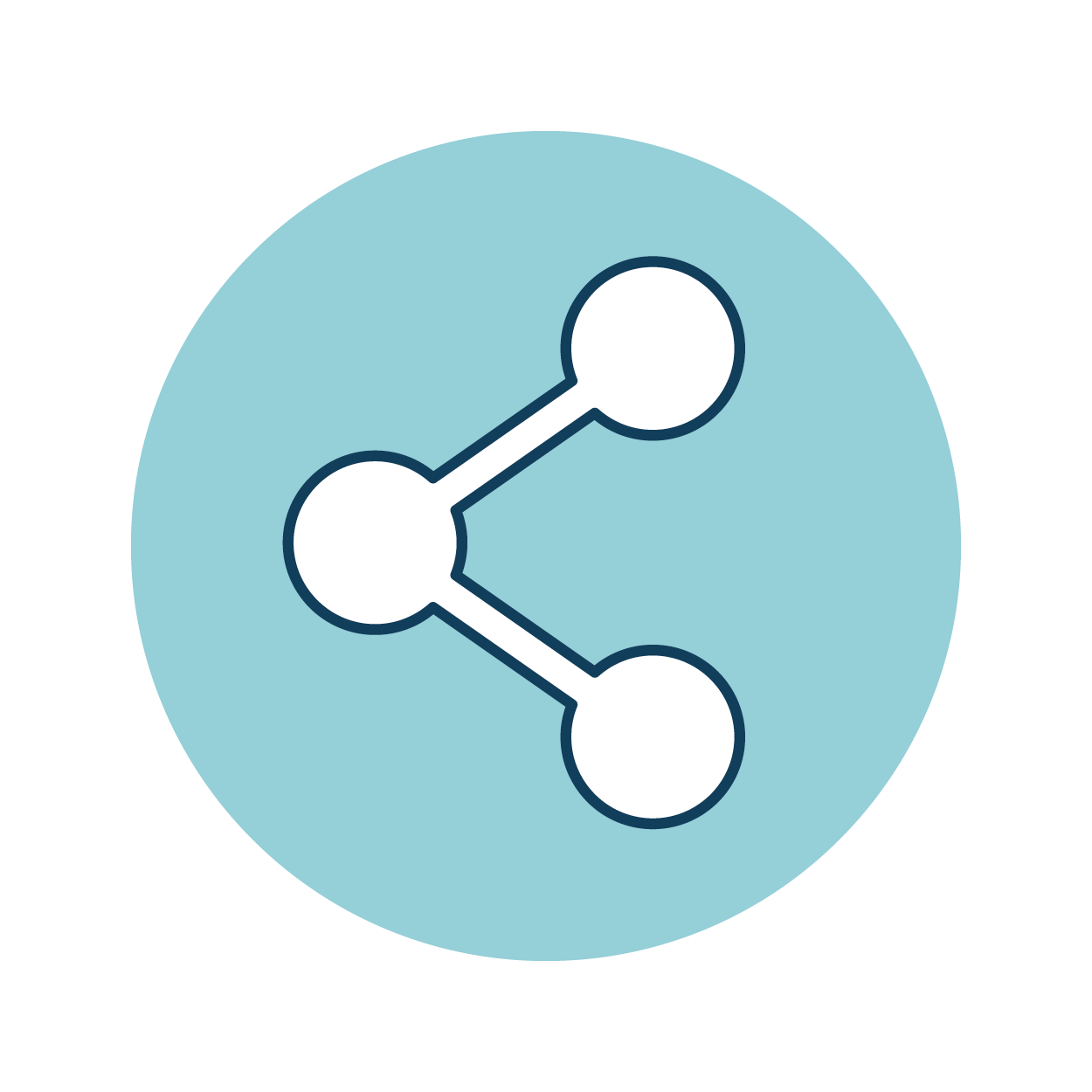

Unfavorable Things to Know About Buying a Short Sale

- The Timeframe Is Completely Different Than a Normal Sale

It can be slow...

Think of a normal home sale: you make an offer, maybe get a counter-offer, go into contract for around 30-40 days, and then close. Not so much with a short sale.

Before you decide you want to buy a home that's being advertised as a short sale, make sure to do your research. Ask the seller what stage they're at in the process of a short sale. Some homeowners panic and think they should put the home up for a short sale immediately after coming into some financial hardship. If they haven't defaulted on their loans, though, then a short sale won't be approved. If they haven't even begun discussing the option with the bank, you could be in for a long ride that has a high probability of ending in you not getting the home. If they talk to their bank they could find a solution that would let them keep the home.

Also, depending on how many companies have liens on the home, coming to a decision to approve a short sale can take a long time. The process could take so long that the home goes into foreclosure, effectively making the seller obsolete... the bank would own the house now, and the seller has no way to sell the home to you.

It can also go extremely fast...

Don't think that you'll just be sitting around waiting for three months to hear if you get the home or not, though. Be prepared to move and move quickly as the short sale process goes along. Some banks will create deals that only last a short amount of time and, if you aren't completely ready with funding lined up and ready to go, you could be the reason the sale falls through. Be prepared to work with a time frame that involves waiting patiently but being prepared for the next step — either moving forward or finding a different option.

- The Sale May Not Go Through

Like we mentioned above, the sale of a short sale property may not actually go through. Don't get your heart set on a property that's in short sale, because you'll never know exactly what will happen. This also means that you can be looking at other short sale properties at the same time to know what your next move is if the property falls through.

- You'll Need a Home Inspection ... But the Property is As-Is

Unfortunately with a short sale (or foreclosure) property, the home won't be pristine and perfect. Any home you purchase that's been lived in before will have slight problems just from having someone live in the home and use the systems and appliances inside. That's why you always get a home inspection — to understand what condition the home is in and, with a normal sale, have the seller reduce the sale of the home or repair the problems before you purchase the property.

With a short-sale home, a seller is already losing money on the sale of the home, and doesn't have enough money to repair or replace broken appliances. The home will be sold as an "as-is" property, so what you see is what you get. If there are major problems with the house you will have to take responsibility to fix them.

Short sale homes often have more problems than normal sales, too. When a seller doesn't have enough money to pay the mortgage every month, they definitely don't have enough money to pay for repairs or even maintenance of their systems and appliances. Add the fact that most sellers could be heartbroken about leaving their home that they take it out on the property, and you could end up with a home in need of major repairs. This isn't as common as it is with foreclosures, though, so you could be better off with a short sale.

Although you could purchase a home warranty, most coverage plans won't be able to repair or replace systems and appliances that are shown to have stopped working before a home's purchase. You should think about purchasing one once repairs have been made, though, to protect your systems and appliances that you maintain. Check out Landmark's options for coverage to see if any will fit with your budget and home on our plans and pricing page.

Favorable Things to Know About Buying a Short Sale

Buying a short sale isn't all bad, though. There's a reason many potential buyers decide to go with a short sale instead of a normal home sale.

- You Can Get a Short Sale for a Lower Price

Because the home is in a possible bad condition, you could get the home for a lower price. Just like if you were looking at fixer-uppers, your price point will be lower for a home because it's not in the best condition.

- You Can Increase Equity Quickly and Sell for Profit

If you purchase a short sale, you can increase the equity of the home just by cleaning up the property. If you're aware that you'll be doing clean up and repairs to the home (which you should know what you're getting into if you get a home inspection before buying) you can be set up to increasing your equity dramatically. Before buying, list out everything that has to be repaired and replaced and price out how much money you will have to pay to get everything done. Begin chipping away at the list bit-by-bit. After finishing the repairs and updates, you can either sell the home for a major profit, or keep living in it if you love where you live.

- With a Good Real Estate Agent, the Process Can Go Smoother

Before venturing into a short sale, make sure to find an experienced real estate agent who is fluent in all things short sales. Make sure your seller has an experienced short sale listing agent as well. This will make sure that your short sale experience goes smoother than dealing with a short sale and an inexperienced realtor.

Buying a short sale and want to protect your systems and appliances after closing? Purchase a home warranty! You can save hundreds on your repairs and replacements when you purchase a home warranty coverage plan. A home warranty will repair or replace your systems and appliances when they fail from normal wear and tear. Learn more and compare plans and pricing for your personalized home here.

Sellling a home? We know that can feel like a maze sometimes. Check out our tips on selling your home as a short sale here.