So, you've decided you want to purchase a home. Let Landmark Home Warranty be the first to wish you congratulations! Home ownership is a rewarding experience and a large investment. As you begin researching the steps to purchase a home, you may have a number of questions running through your mind, including: "These are a lot of different steps, how long will all of this take?"

First off, you're right. The process to purchase a home has a number of different steps. If only it was as easy as buying your groceries "“ you look, you decide, you buy. Unfortunately, a gallon of milk doesn't generally require you to get a loan or have an inspection to see if it's worth the few dollars you're spending to purchase it. Since a home is such a large investment, the process to purchase is much more complex. Although we don't have the space to go over every detail of purchasing a home, we can go over the general steps and explain on average how much time each of those takes. Remember, every home's sale is different and takes various amounts of time depending on your situation, but this is a great overview.

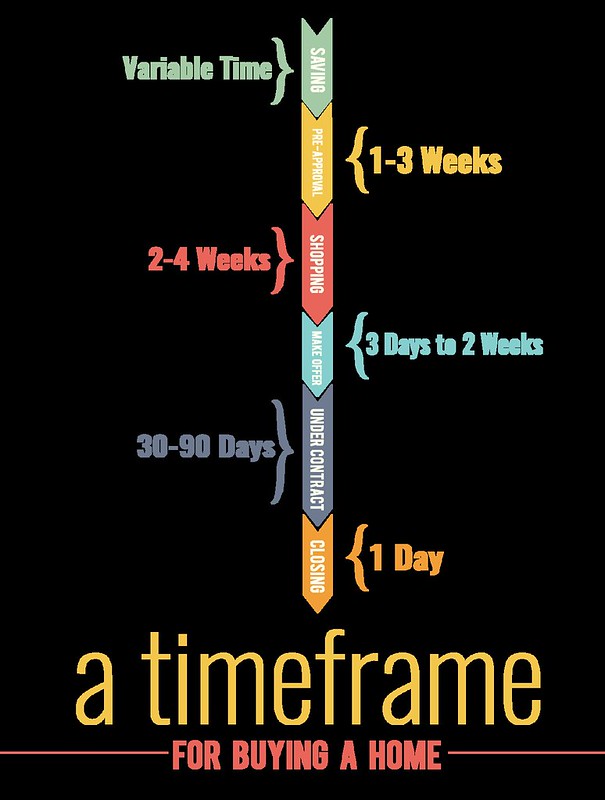

Step 1: Saving for a Home

Average time to save for a down payment: less than a year to 10 years

If you go the traditional 20% rule for a down payment, saving up for a home completely depends on your income level, how much the home costs and how much money you can save at a time. It could take years to save up for a 20% down payment.

Luckily, for first-time homebuyers, there are a number of options for loans and down payment assistance programs that can help them pay a much smaller percentage (3 to 5%) or no down payment at all with their loans. There are also a number of grants that don't have to be repaid that can provide Down Payment Assistance to individuals, including paying for closing costs. Generally, these loans and DPAs need to have a lower debt-to-income ratio, a fairly good credit score, and lower income.

If a homebuyer opts to go with one of these options, saving for a home is all but eliminated, and home buyers can go straight into finding a mortgage and a realtor.

Step 2: Getting Pre-Approved for a Mortgage and Finding a Realtor

Average time: one week to three weeks

Once you've decided you want to purchase a home, the next step is to get pre-approved to see how much you can afford in a home, and show a realtor you're serious about buying a home.

Getting pre-approved for a mortgage involves you giving your credit score, income, debts, assets and other various information to a mortgage lender. The lender will look at your finances and determine if you're likely to be approved for a mortgage, as well as how much money you could potentially qualify for when actually applying for a loan. This is not a guarantee of funds, but when you show it to a realtor, they will know you're serious about getting a home and that you've done your homework. This process generally takes less than a week, as long as you have all of your paperwork to show proof of income and assets. A pre-approval letter and credit report are generally good for 60-90 days.

After you have this pre-approval letter, you can begin interviewing real estate agents. This process can take a week or two, perhaps up to a month for you to find the right person for you. Make sure to ask questions about their specific knowledge of where you're planning on buying, and what they think about your goals for buying a home. Once you find the perfect realtor, sign an agreement to legally work with them on finding a home for you, and continue on with home shopping.

Step 3: Shopping for a Home

Average time: two weeks to a month (or more!)

Now, the fun part! Start looking for homes that meet your needs. You may want to create a "must have" list and a "nice to have" list. Your "must haves" may be things like close commute to work, a washer and dryer hookup upstairs instead of in a basement or a certain number of rooms and bedrooms. Your "nice to haves" may be things like a patio, shutter color or type of bushes in the garden.

Let your realtor help walk you through different homes in your price range and find the one you absolutely love. How long does it take for you to know what home is right for you? Some experts say 8 homes ... others, 17 minutes. When you've found the perfect home, make an offer.

Step 4: From Offer to Under Contract

Average time: three days to two weeks

When you make an offer on a home, you'll be expected to include earnest money. This is a small amount of money that will go toward your closing costs, and it lets the seller know you are serious in your intent to purchase their home. Once an offer has been placed, there are three options the seller has:

- Accept the offer, and the house goes into closing. This usually takes around three days.

- Reject or counter-offer sometimes giving specific reasons why. You can accept the counter-offer, or counter-offer back if further negotiations are desired. This process can take days to weeks.

- Outright ignore the offer if you don't include a pre-approval or earnest money deposit.

If everything goes well, this process only takes a few days to a week and you will be under contract on your new home.

Step 5: Under Contract to Closing

Average time: 30 days to 90 days

This is the most important part of buying a home. This is when you get a home inspection on the property, and ask for certain items to be repaired or replaced or the price reduced depending on the state and condition of the home. Then, you have to get a commitment letter from a mortgage lender (which means you have a loan to buy a home.) This involves a lot of underwriting of the legal terms of the mortgage, and can take a longer time as the mortgage is written and drafted and your credit and financial information is researched. On average, this takes around 30 days. The home goes into escrow, and a home warranty is purchased for the homebuyers to protect their systems and appliances from failure. A title company performs a title search, writes a title opinion, property survey, and offers title insurance. All of these items has to fall into place to purchase the home.

Step 6: Closing on a Home

Average time: a half day to a day

Finally, you get to close on your home! You go on a final walk-through of the home and sign, sign, sign. There are a lot of different documents that have to have your signature on them in order to complete the sale of a home. This process can take a full day, on average, but once closing is complete, you own the home!

All in all, on average from start to finish the home buying process takes two to four months. Remember, during closing or after you've purchased the home, ensure you have home warranty protection on your home's systems and appliances. A home warranty will repair or replace the main systems and appliances in a home when they fail from normal wear and tear. When you're moving into a home with virtually no idea of how the home was treated before you lived in the house, you'll be grateful for the peace of mind a home warranty provides you "“ especially when it saves you hundreds of dollars! Find the perfect plan for you and your home here.